Provided in addition to the mortgage loan product “New house” allocated in the amount of 420 mln soums in the city of Tashkent and 330 mln soums in the regions from the funds of the Ministry of Economy and Finance of the Republic of Uzbekistan, for the purchase of apartments in multi-storey buildings on the primary housing market.

General terms

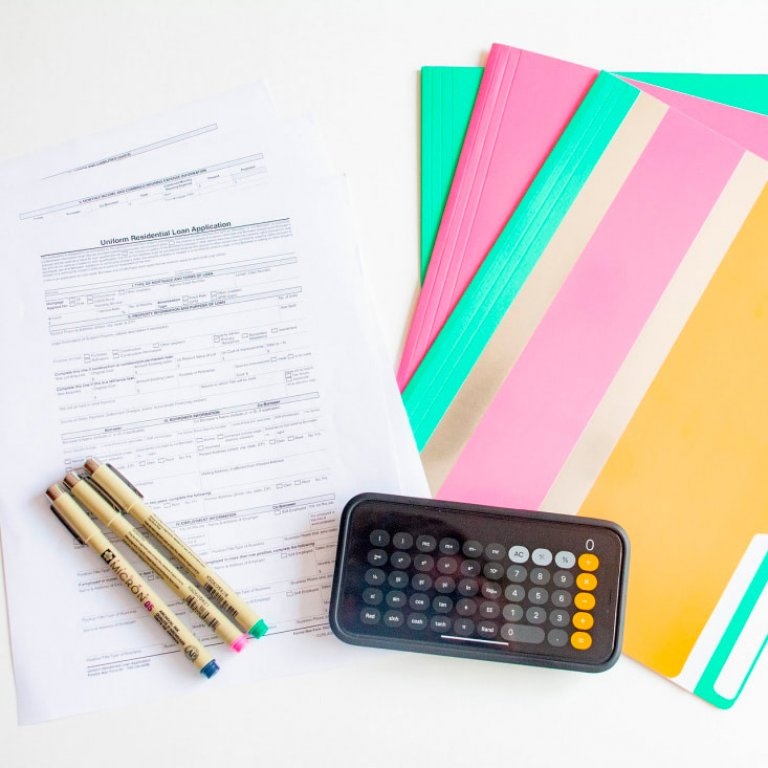

2. Identity document (passport, ID card, residence certificate, etc.);

3. Contract of purchase and sale of housing concluded with the contracting organization-seller;

4. Loan security documents;

5. If necessary, documents confirming the availability of permission from the authorized body for the construction of a multi-storey building in which the loaned object is purchased, acquired through a loan (decision of the khokim, etc.);

6. Extract from the cadastral register of the purchased apartment;

7. Self-employment certificate. (when the loan is provided to self-employed persons). The Bank reserves the right to request additional documents for the most complete analysis of the solvency of the Borrower/Co-Borrower.

We are happy to help you

Our consultants will help you solve any issue. Just give us a call or request a call back.

The Alliance mobile application is equipped with interactive services and a calculator.

An online chat with the Bank's Support Service is also available.

You don't have to go anywhere! The Alliance Pay application will allow you to redeem it anywhere in the world, the main thing is that there is Internet! The payment process is as simple as possible.

aab.uz

aab.uz