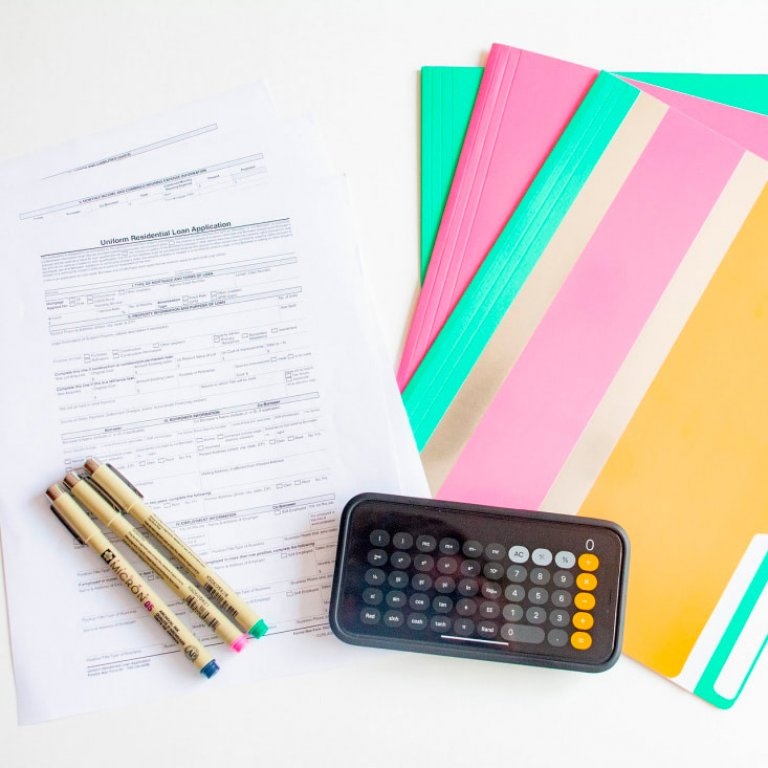

General terms

Loan target

Purchase of an individual residential house or apartment on the primary or secondary housing market.

Loan currency

Sum

Loan amount

Up to 3200 BRV for Tashkent, up to 2400 BRV for regions of Uzbekistan

Initial payment

From 26% (with official income), from 30% (for self-employed individuals)

Interest rate

28% per annum

Credit term

Up to 144 months

Loan processing method

Bank branch

Collateral

Collateral of the purchased property

Grace period

yes (12 months)

Repayment method

Differentiated, Annuity

Frequency of payments

Monthly

Borrower requirements

Residents of Uzbekistan, aged 18-60, officially employed or self-employed

Loan Provision Order

Non-cash

Required Documents

1. Application for a loan;

2. Identity document (passport, ID card, residence certificate, etc.);

3. Loan security documents;

4. One of the following documents about persons registered at the place of residence together with the borrower: A) A copy of the pages of the house book containing the latest information about the persons registered in the residence / apartment with the borrower. The credit manager copies the corresponding pages of the house book;

B) Certificate of internal affairs bodies on persons registered at the given place of residence/apartment;

C) Information about persons registered in this place / apartment was obtained from the Center for Public Services or on the official website www.my.gov.uz. When buying an individual residential building or an apartment in a multi-storey building on the primary market: 5. Investment agreement;

6. Documents confirming the availability of permission from the authorized body for the construction of a multi-storey building in which the loaned object is purchased, or for the construction of an individual residential building purchased at the expense of a loan (decision of the khokim, etc.) 7. Documents on mortgage of residential or non-residential real estate for temporary loan security. The Bank reserves the right to request additional documents for the most complete analysis of the solvency of the Borrower/Co-Borrower

2. Identity document (passport, ID card, residence certificate, etc.);

3. Loan security documents;

4. One of the following documents about persons registered at the place of residence together with the borrower: A) A copy of the pages of the house book containing the latest information about the persons registered in the residence / apartment with the borrower. The credit manager copies the corresponding pages of the house book;

B) Certificate of internal affairs bodies on persons registered at the given place of residence/apartment;

C) Information about persons registered in this place / apartment was obtained from the Center for Public Services or on the official website www.my.gov.uz. When buying an individual residential building or an apartment in a multi-storey building on the primary market: 5. Investment agreement;

6. Documents confirming the availability of permission from the authorized body for the construction of a multi-storey building in which the loaned object is purchased, or for the construction of an individual residential building purchased at the expense of a loan (decision of the khokim, etc.) 7. Documents on mortgage of residential or non-residential real estate for temporary loan security. The Bank reserves the right to request additional documents for the most complete analysis of the solvency of the Borrower/Co-Borrower

Loan Service Fee

None

Additional Conditions

Early repayment allowed;

insurance premium 125% of the loan amount

insurance premium 125% of the loan amount

We are happy to help you

Our consultants will help you solve any issue. Just give us a call or request a call back.

If you have questions about deposits, our consultants will answer them.

Single Call Center

Work schedule: 24/7

The Alliance mobile application is equipped with interactive services and a calculator.

An online chat with the Bank's Support Service is also available.

Additional information

Make payments on loans at any time convenient for you

You don't have to go anywhere! The Alliance Pay application will allow you to redeem it anywhere in the world, the main thing is that there is Internet! The payment process is as simple as possible.

Other loans

aab.uz

aab.uz